Irs Gas Mileage Rate 2025 - Irs Gas Mileage 2025 Lita Sherri, Notable rates are listed below: What is the 2025 federal mileage reimbursement rate? This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

Irs Gas Mileage 2025 Lita Sherri, Notable rates are listed below: What is the 2025 federal mileage reimbursement rate?

Irs Standard Mileage Rate 2025 Nora Thelma, This rate covers various vehicle costs, such as. 67 cents per mile driven for business use,.

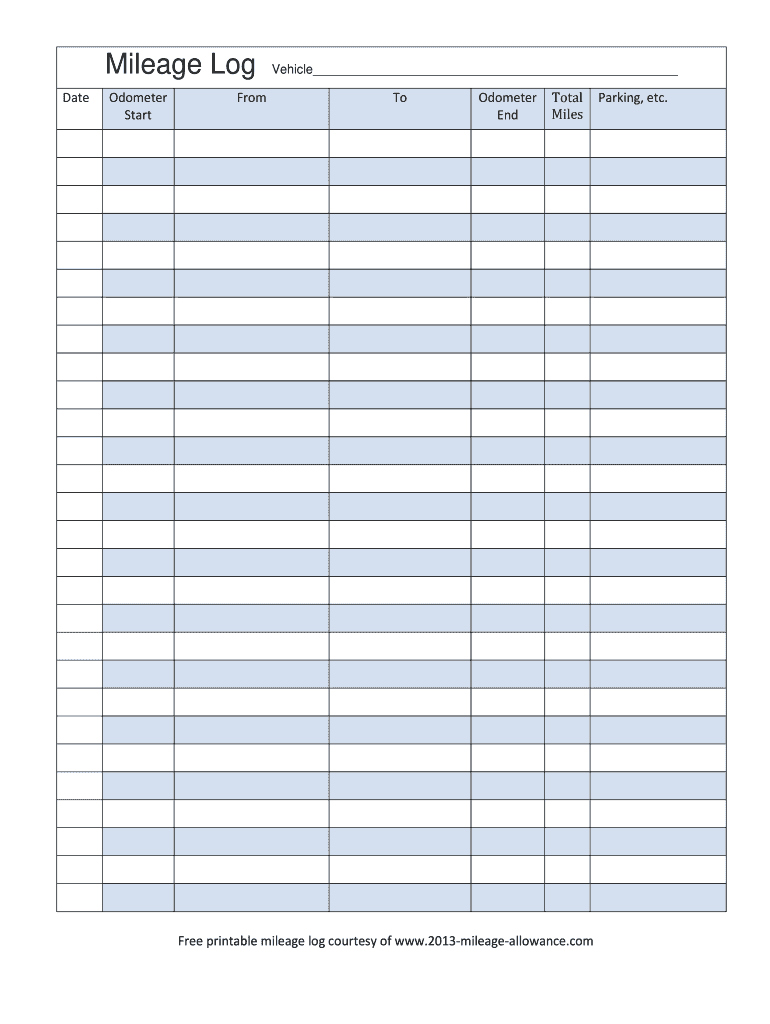

Gas Mileage Expense Report Template, The irs mileage rates for 2025 vary based on the purpose of travel. The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes.

Irs Gas Mileage Rate 2025. The 2025 standard mileage rate is 67 cents per mile, up from 65.5 cents per mile last year. The 2025 medical or moving rate is 21.

Irs Mileage 2025 Reimbursement Rate 2025 Heda Rachel, 67 cents per mile driven for business use,. The new rate kicks in beginning jan.

2023 IRS Standard Mileage Rate YouTube, The following lists the privately owned vehicle (pov) reimbursement rates for automobiles, motorcycles, and airplanes. 67 cents per mile for business.

1, 2025, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 67 cents per mile driven for business use (up 1.5 cents.

Gas Mileage Expense Report Template, 67 cents per mile for business. You can use this mileage reimbursement calculator to determine the deductible costs associated with running a vehicle for medical, charitable,.

The IRS Issues 2025 Optional Standard Mileage Rates Wage & Hour, Remember to check for new guidelines. 67 cents per mile for business.

IRS Mileage Reimbursement Rate 2025 Recent Increment Explained, 67 cents per mile for business. The irs bumped up the optional mileage rate to 67 cents a mile in 2025 for business use, up from 65.5 cents for 2023.

IRS Issues 2025 Standard Mileage Rates UHY, Notable rates are listed below: The updated rates are 67 cents per mile for business, unchanged at 14.

Irs Increases Mileage Rate For Remainder Of 2025 Angel Blondie, According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs. The irs has announced the standard mileage rates for the use of a car, van, pickup, or panel truck for the year 2025.