Fsa Employer Contribution Max 2025 Over 50 - Fsa Employer Contribution Max 2025 Over 50. Ogb will be extending annual enrollment for employees who entered the 2023 maximum amount of $3,050. Each year, the irs sets the contribution limits for individuals opening an fsa. Family Fsa Contribution Limit 2025 Over 50 Lisha Philipa, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2023. The adjustment for 2025 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2023.

Fsa Employer Contribution Max 2025 Over 50. Ogb will be extending annual enrollment for employees who entered the 2023 maximum amount of $3,050. Each year, the irs sets the contribution limits for individuals opening an fsa.

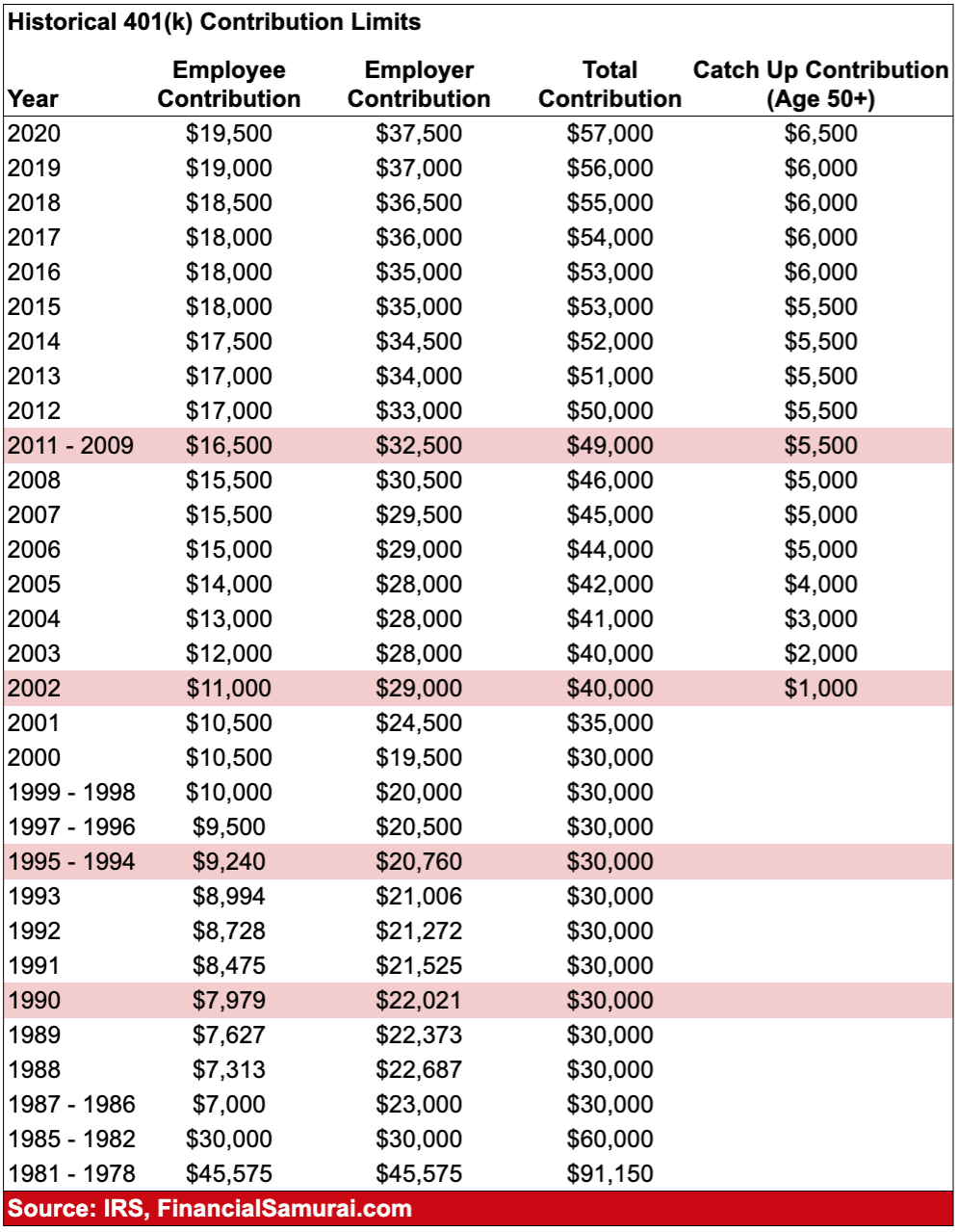

401k Match Limit 2025 Amye Madlen, The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in. But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

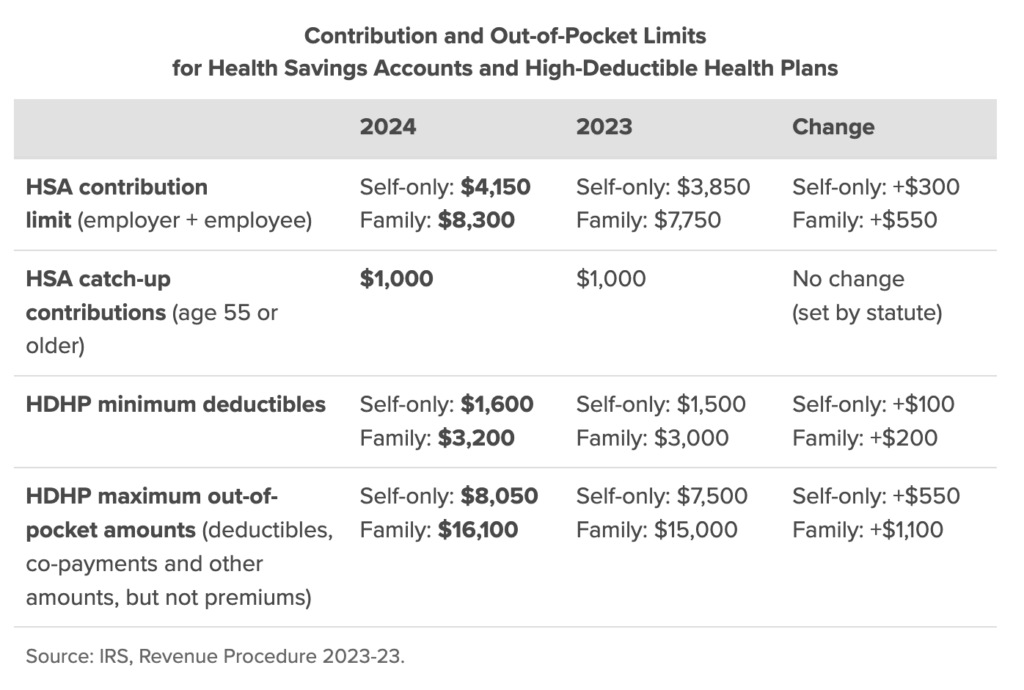

Hsa Contribution Limits For 2023 And 2025 Image to u, If the plan allows, the. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

On november 10, via rev. The latest mandated fsa employee contribution limits on how much employees can contribute to these accounts is shown in.

2025 Hsa Contribution Limits And Fsa And Hsa Gisele Gabriela, Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2023. If you don’t use all your fsa funds by the end of the plan year, you may be able to carry over $640.

2025 Max Hsa Contribution Limits Over 50 Lacey Aundrea, If your employer offers it, you can roll over unused fsa funds to the new year. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions.

The fsa contribution maximum for the 2025 plan year is $3,200.

Employers can allow employees to carry over $640 from their medical fsa for taxable years beginning in 2025, which is a $30 increase from 2023.

Dependent Care Fsa Limit 2025, The irs has recently disclosed adjustments to contribution limits for 2025, bringing some changes to both fsas and hsas. Those 55 and older can.

Maximum Fica Contribution 2025 Abra, But if you do have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). The irs has just announced updated 2025 fsa contribution limits, which are seeing modest increases over 2023 amounts.

401(k) Contribution Limits 2025 What Employers Need to Know, The irs has recently disclosed adjustments to contribution limits for 2025, bringing some changes to both fsas and hsas. What is the 2025 maximum fsa contribution?

What Is The Maximum Amount Of 401k Contribution For 2025 Emili Janessa, The 2025 maximum health fsa contribution. The internal revenue service (irs) announced new cola adjustments and maximum fsa contribution limits for 2025.